Bond selling price calculator

The required rate of return is 8. Calculate the coupon rate.

Zero Coupon Bond Formula And Calculator Excel Template

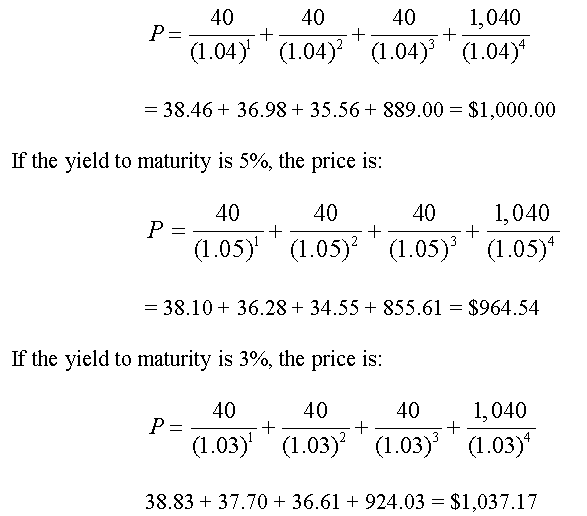

The present value or current market value of this bond is.

. Determine the Interest Paid by the Bond. And the annual coupon payment for Bond A is. If the current market rate is below the coupon rate then the.

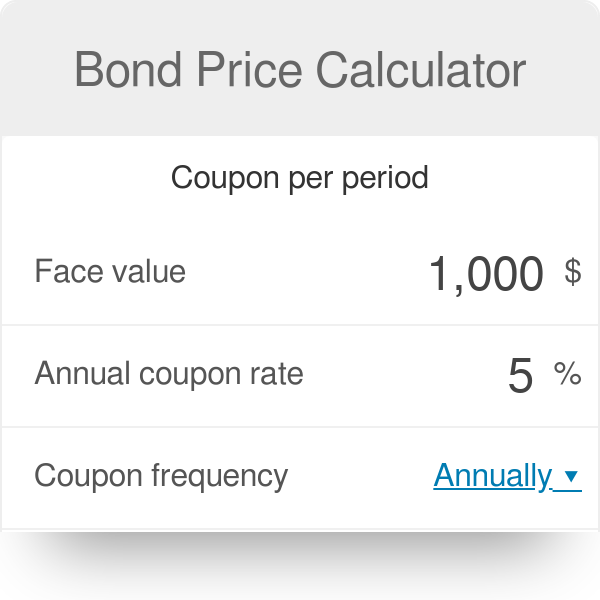

Our free online Bond Valuation Calculator makes it easy to calculate the market value of a bond. The Calculator will price paper bonds of these series. A bond may or may not.

The first step is to determine the interest paid. Bond price calculators results - some. To calculate the yield for a given price see the Bond Yield to Maturity Calculator.

EE E I and savings notes. Bond price - while bonds are usually issued at par they are available in the resale market at either a premium or a discount. Bond pricing is the formula used to calculate the prices of the bond being sold in the primary or secondary market.

In that scenario estimating the bond premium and discount are straightforward. To calculate current yield we must know the annual cash inflow of the bond as well as the current market price. The coupon rate is 10 and will mature after 5 years.

Coupon payment every year is. On this page is a bond yield calculator to calculate the current yield of a bond. You can use this Bond Yield to Maturity Calculator to calculate the bond yield to maturity based on the current bond price the face value of the bond the number of years to maturity and the.

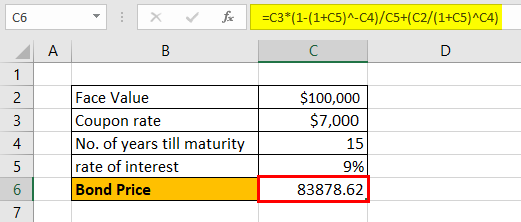

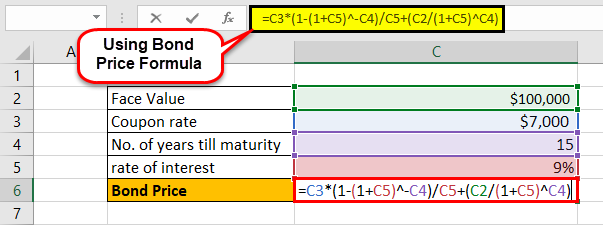

Issues can use the following. The price of the bond calculation using the above formula as Bond price 8387862 Since the coupon rate is lower than the YTM the bond price is less than the face value and as such the. Bond Price Cn 1YTMn P 1in.

You can find it by dividing the annual coupon. Incredibly Easy to Use Enter the information required and you will have the answer that youre looking for in only a few. Access Bond Calculator whenever you need it across our website.

It is the amount that is payed to the. The purpose of this calculator is to provide calculations and details for bond valuation problems. The bond pays out 21 every six months so this means that the bond pays out.

It is assumed that all bonds pay interest Semi-Annually. Enter the bonds trading price face or par value time to maturity and coupon or stated interest rate to compute. How to Use the Bond Calculator Your inputs.

Calculate the price of a bond whose face value is 1000. To use our free Bond Valuation Calculator just enter in the bond face value months until the. The last step is to calculate the coupon rate.

The first involves issuers issuing their bonds at a higher or lower price. Find out what your paper savings bonds are worth with our online Calculator. Bond price 79870 In our bond price calculator you can follow the present values of payments on the bond price chart for a given period.

To solve for your bonds new price select I want to solve for price. N Period which takes. The basic steps required to determine the issue price are noted below.

Enter the current market rate that a similar bond is selling for only numeric characters 0-9 and a decimal point no percent sign. 25 2 50. Interest of 30000 paid at the end of each of 4 semiannual periods discounted by 4 per semiannual period 108897 Maturity.

Alternatively if the bond price and all but one of the characteristics are known the last missing characteristic can be solved for. If a bond is quoted at. You can use the calculator to see how your bonds price will change to reflect changes in the yield to maturity.

Face Value This is the nominal value of debt that the bond represents.

An Introduction To Bonds Bond Valuation Bond Pricing

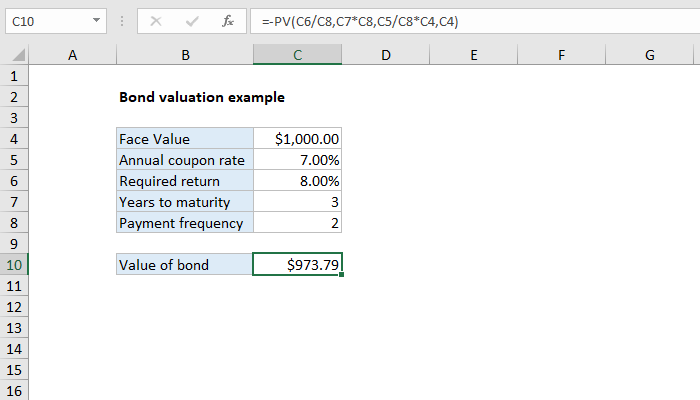

How To Calculate Bond Price In Excel

Bond Price Calculator Formula Chart

Bond Yield Formula Calculator Example With Excel Template

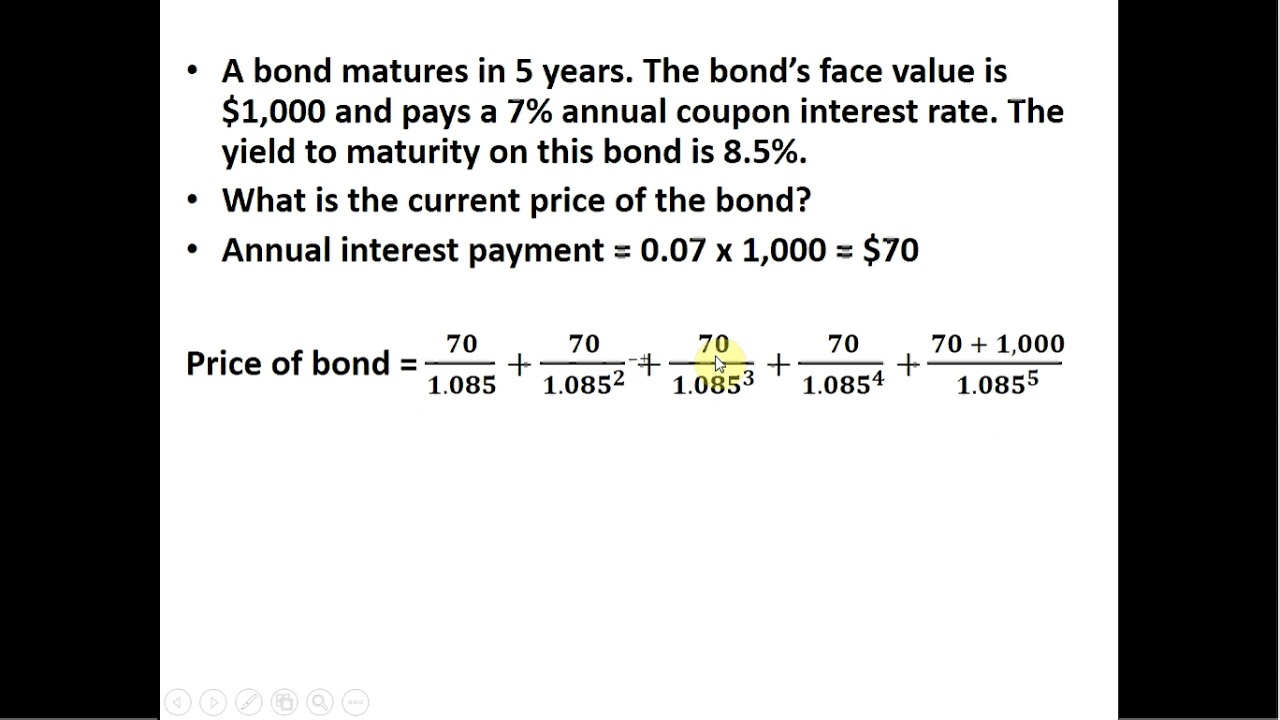

Bond Pricing Formula How To Calculate Bond Price Examples

Learn How To Calculate Bond Price Value Tutorial Definition Formula And Example

How To Calculate Pv Of A Different Bond Type With Excel

How To Calculate Bond Price In Excel

Bond Pricing Formula How To Calculate Bond Price Examples

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Current Yield Vs Yield To Maturity

Bond Pricing Formula How To Calculate Bond Price Examples

Bond Yield Calculator

Coupon Bond Formula How To Calculate The Price Of Coupon Bond

Excel Formula Bond Valuation Example Exceljet

How To Calculate The Current Price Of A Bond Youtube

Bond Price Calculator Exploring Finance

Yield To Call Ytc Bond Formula And Calculator Excel Template